Aspects of financial literacy

Financial skills are needed in all activities where money is involved: in buying, saving or borrowing. Financial skills are necessary, particularly in large purchases, such as a car or a home.

Everyday spending

We spend money everyday on many kinds of purchases. Nowadays, most payments are made virtually, which is why we need to be aware of how much money we spend, what we spend it on and how sufficient our income is to cover various expenses. Monitoring the prices of your own “consumption basket” is also important, particularly when inflation accelerates. It is good to monitor how money is spent. Various virtual tools are available for this purpose.

Planning your own finances

By planning your own finances, you keep your income and expenditure in balance. Financial planning may be short term (e.g. a month) or long term (e.g. a year). Some expenditure is fixed monthly (e.g. rent), while other expenditure is variable (e.g. clothing). Having a plan for various expenditure items helps you to manage your consumption and prepare for future consumption.

We need to be aware of how much money we spend.

Investing and owning

Investing requires systematic planning and information gathering. It is necessary to be clear about what kind of investment product is right for you and your finances. The risk associated with investing and its relationship to expected returns must be understood. Owning expensive consumer durables necessitates maintenance as well as monitoring of the market situation, particularly when it comes to selling them.

Purchases and borrowing

Expensive, investment-type purchases are often made with borrowed money. Credit may also be used for other purchases. You should familiarise yourself properly with the various credit products and the terms and conditions attached to them. Repayment of credit must be adapted to your personal finances. This needs to be taken into account in financial planning.

In order to receive credit, you must be at least 18 years of age. Credit and credit cards are usually granted by companies specialising in it. Since paying using credit always involves risks, the lender often wants to ensure that customers are able to fulfil their obligations, that is, repay the credit with interest and expenses. Before paying with credit, it is also worthwhile considering what risks are associated with credit and paying with a credit card.

Even though you are able to spread the payment of a purchase over a longer period of time by paying using credit, is the total credit price often more than the cash price.

First, when paying using credit, you need to be aware what credit really means. Credit is money you have borrowed, meaning debt. It must always be paid back. Even though you are able to spread the payment of a purchase over a longer period of time by paying using credit, you must bear in mind that the total credit price is often more than the cash price. This is due to the fact that when you pay using credit, you will incur additional costs on top of the amount borrowed.

The price of credit consists of the amount borrowed, interest and other expenses related to the credit. Credit is therefore never free, and when you make a transaction using credit, you will be indebted to the lender. Before applying for credit, you should therefore consider whether you are able to make the payments in the future. Usually credits are paid back in monthly instalments. Therefore you will need regular income to repay the credit. For example when buying a computer, you should consider whether you could first save up a proportion of the price and only finance a part of the price with credit.

What risks are involved with credit? When taking on credit, you are always taking a risk concerning your future ability to repay, since the credit agreement may bind you for a long time. If you end up being unable to repay credit, in other words a loan that has been granted to you, it may cause you to get a bad credit rating for several years. A bad credit rating can be a hindrance in everyday life, in many ways: it becomes harder to rent a flat, you are unable to make a hire purchase agreement or you will have to pay your phone bill in advance. Hence, taking out a loan is something to consider carefully.

Saving and financial preparedness

The coronavirus period revealed the poor financial preparedness of Finnish households. In case of sudden loss of income or increase in expenditure, a household should have money in reserve to cover 1-3 months’ spending. Financial buffers are built up by saving or investing. It is essential that the funds are quickly available when needed.

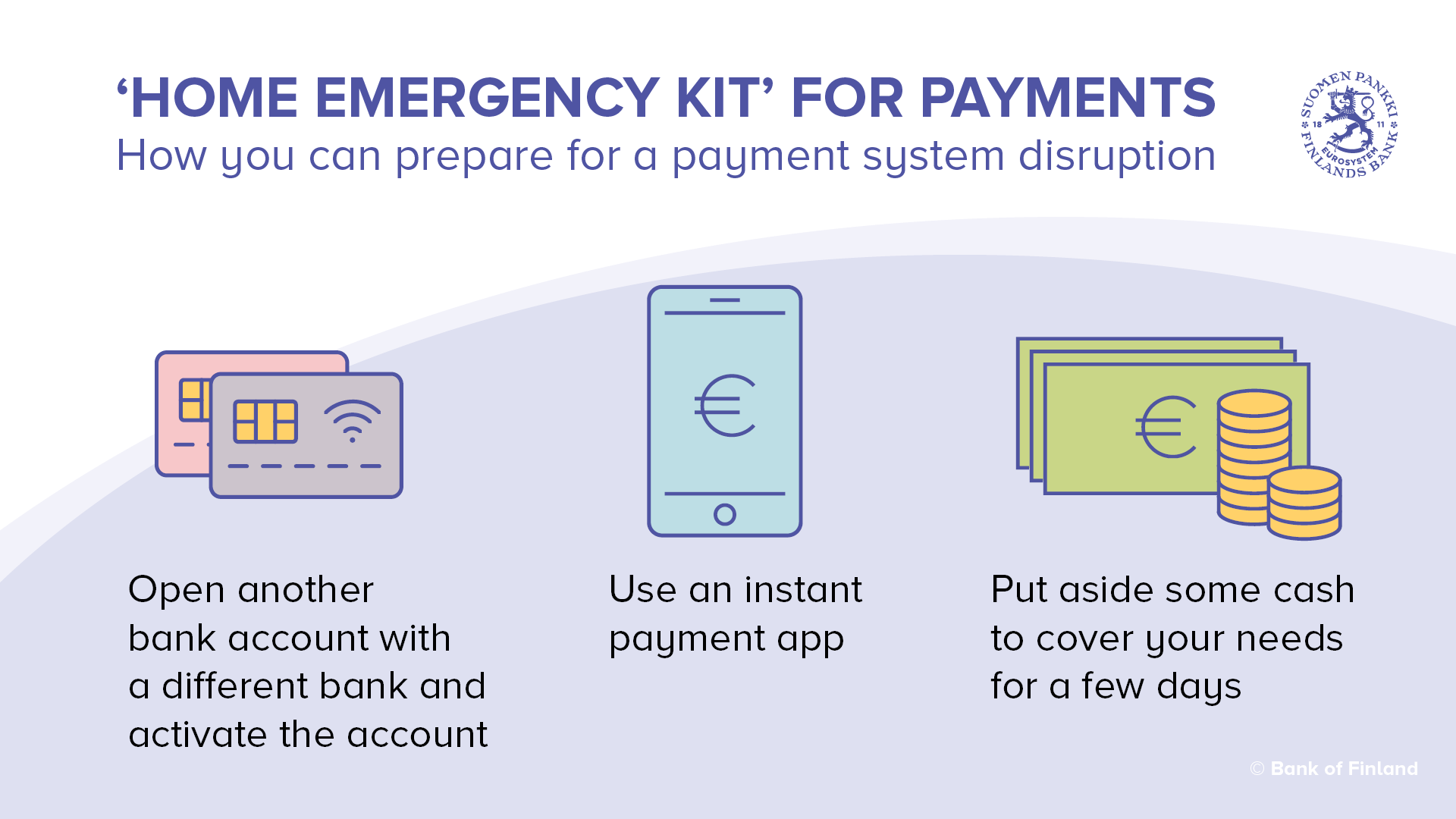

‘Home emergency kit’ for payments

Geopolitical uncertainties are increasing the likelihood of cyber risks and other external influencing in the financial sector. Preparedness in the financial sector and among the authorities is at a good level, however. Household preparedness is also of considerable importance to society, and especially to household members themselves. That’s why each of us ought to make sure we are prepared.

1. Open another account with a different bank and activate account

It would be useful if households were to have bank accounts and payment cards in two different banks in case the services of one bank become unavailable for a period of time. It is also worth activating the online and mobile banking services for these accounts. Make sure that your personal details and contact information are up to date.

Online banking codes are used not only for payments but also for online identification needs in many different services where reliable identification is required. For identification purposes, it is worth considering whether you should acquire online banking codes from another bank or perhaps a mobile ID from a telecommunications operator.

2. Use an instant payment app

To improve the certainty of being able to manage your everyday money matters in all situations, you could start using mobile apps for making payments. An instant payment app based on the Finnish Siirto system, for example, would be a good addition to your range of payment methods. Siirto transmits payments in real time between accounts in the participating banks. Ask your bank about the service.

3. Keep cash for several days' needs

A small amount of cash is good to have at home as part of a normal level of preparedness. The recommendation is to have enough for three days. Take a moment to think about how much your household would need as a minimum over such a 72-hour period if you cannot use payment cards. It is not advisable, however, to keep large amounts of cash at home.