Financial literacy

Financial literacy is a key civic skill that enables citizens to make short- and long-term decisions about their own finances and to participate in financial activities in society and the marketplace. Financial literacy is needed in all areas of our own finances: everyday spending, planning and financial preparedness, purchasing, borrowing, saving, investing/owning and insuring.

Financial literacy consists of financial knowledge (understanding financial concepts and risks), financial behaviour (financial activity) and attitudes (motivation and self-confidence to find, understand and assess financial information).

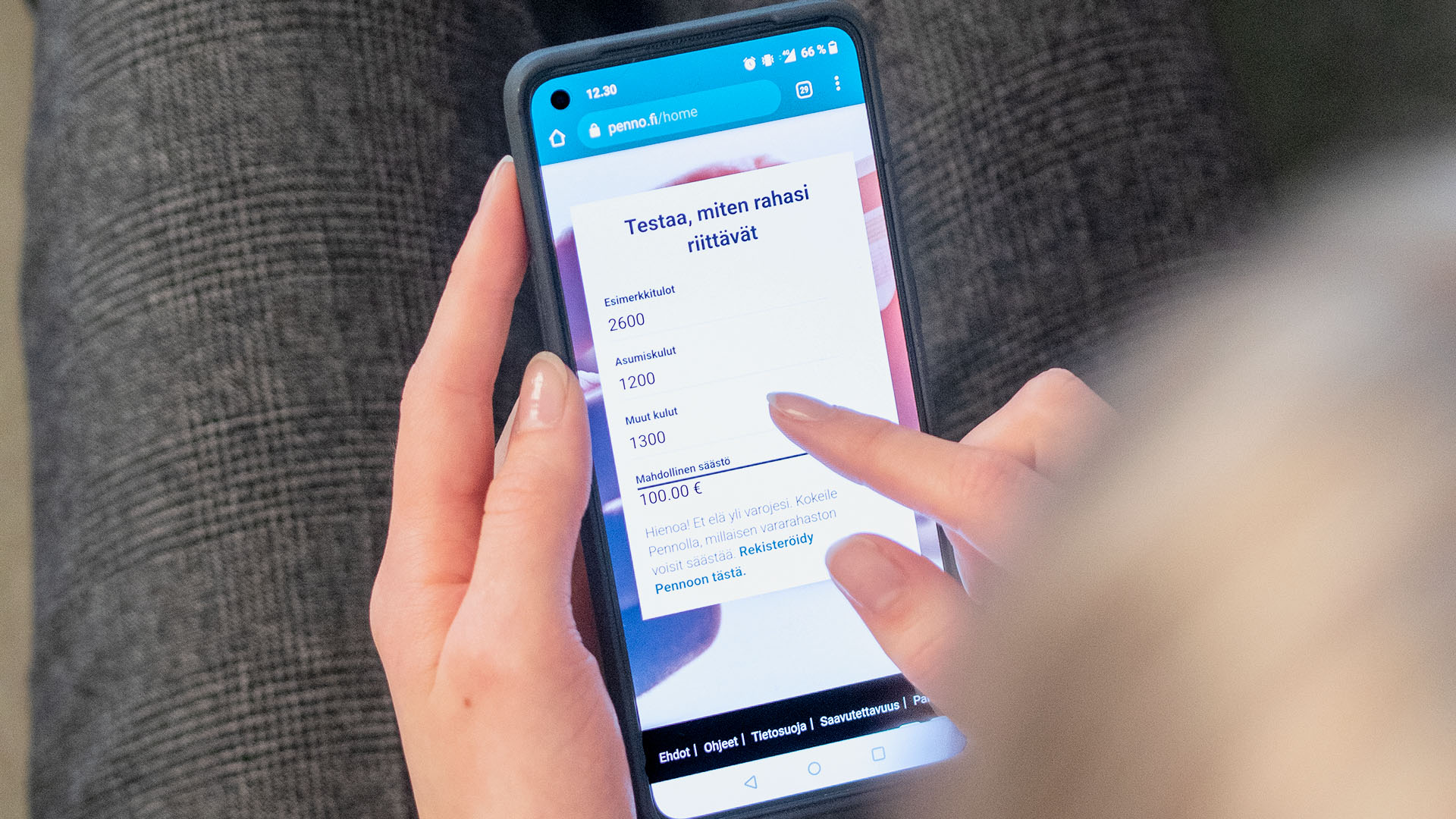

Financial literacy needs to be updated as the economic environment changes. As financial matters increasingly migrate to a digital operating environment, one can speak of digital financial literacy.

We all need support in managing our financial matters at some point in our lives. Financial literacy needs vary, for example at different life stages and income levels. At all of these stages and levels, people need support with their financial literacy, but the content of this support varies. Financial literacy challenges are common to all life stages and situations, but are particularly critical at life’s transition stages and in crises, such as starting independent life, starting a family, relationship breakdowns, unemployment, illness or retirement.

Financial lessons are learned at different stages of life and in different contexts. A key place for financial education is the school system. In addition, the Finnish authorities and a number of private and third-sector actors are doing significant work to promote financial literacy among citizens.

Financial literacy promotes the wellbeing of both individuals and society as a whole. Financial literacy proactively prevents financial problems, which is important because fixing problems is in many ways more expensive than tackling them in advance. Through the prevention of over-indebtedness, financial literacy is connected to financial stability.

Financial literacy promotes the wellbeing of both individuals and society as a whole.

Recently, the financial sector has taken on a sustainability perspective. Sustainable financial products and services that citizens need to understand for their own finances are coming on to the market. We need knowledge about, for example, the environmental effects of our purchases (re-use and recycling) as well as the sustainability aspects of sustainable investment and investment products. The new options will complicate the financial environment and may make our decision-making more difficult. Our financial decisions may have a wider social impact. Our financial literacy therefore needs to be updated: with the kind of knowledge, skills and attitudes that will enable us to make financial decisions in line with our own sustainability outlook, taking the environment, society and governance into account. In addition, this knowledge also includes an understanding of how companies operate, such as recognising greenwashing and understanding sustainability labels.