Financial stability

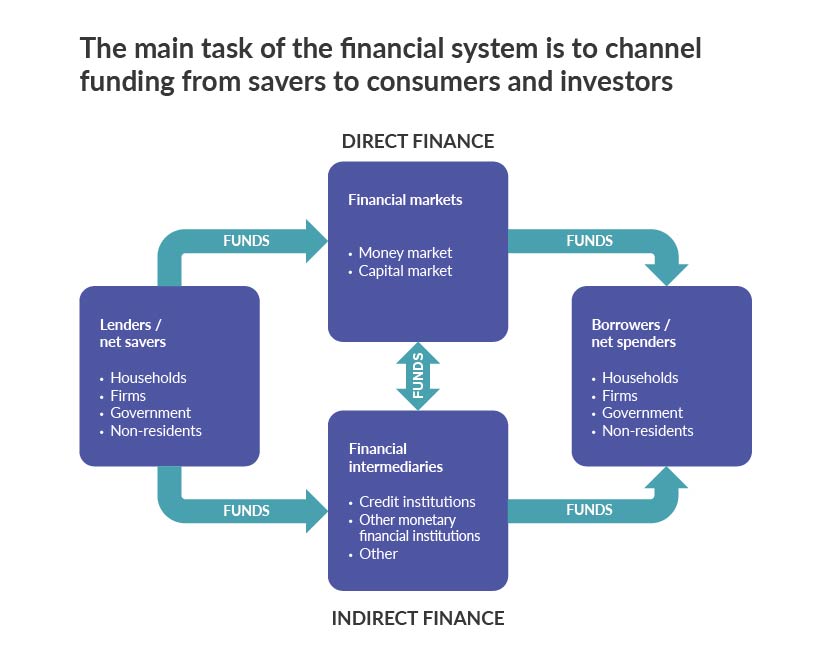

A key function of the financial system is to channel funding from net savers to those who need funding. Efficient allocation of funding and financial stability contribute to economic growth and wellbeing. The Bank of Finland supervises financial stability in collaboration with the Financial Supervisory Authority. Supervision is directed at banks and insurance companies, to ensure that they comply with the laws, rules and regulations targeted at them. Supervision aims to ensure that the risks to the financial system remain under control.

The stability of financial markets is based on the responsible actions of banks, investors and borrowers. Through regulation and supervision, the authorities aim to ensure that the risks to the financial system remain under control.

Macroprudential stability means the stability of the financial system as a whole, i.e. its smooth functioning in all circumstances. A stable and reliable financial system is a prerequisite for price stability and stable economic growth.

Financial stability creates stable conditions for society as a whole.

Financial stability creates stable conditions for society as a whole. Serious disruptions to the financial system impose costs on different sections of society. The Bank of Finland is responsible for maintaining confidence in the financial system and ensuring its efficiency and development. Promoting financial market stability is a statutory task of the central bank.